Monthly crude oil production ranged between 1.6 million bbl/d and 2.0 million bbl/d. Oil accounts for more than 90% of the country’s revenue and more than 60% of government spending.

International Oil Companies

Foreign companies operating in joint ventures (JVs) or production sharing contracts (PSCs) with the Nigerian National Petroleum Corporation (NNPC) include ExxonMobil, Chevron, Total, Eni/Agip, Addax Petroleum (recently acquired by Sinopec of China), ConocoPhillips, Petrobras, StatoilHydro, and others.

Refineries

In 2009, Nigeria consumed approximately 280,000 bbl/d of oil. The country has four refineries (Port Harcourt I and II, Warri, and Kaduna) with a combined capacity of around 500,000 bbl/d.

Sector Organization

NNPC regulates the Nigerian oil industry including upstream and downstream developments. It now has 12 subsidiary companies in order to better manage the country’s oil industry. The majority of Nigeria’s major oil and natural gas projects are funded through JVs, with the NNPC.

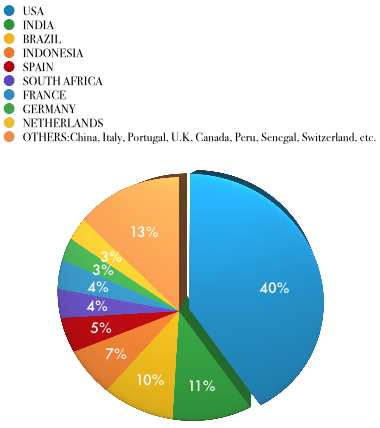

Oil trade partners

For so long we have failed to leverage our position and relationship with our major partners. The United States and more recently Brazil have the kind of technological advancement that we can take advantage of, a kind of relationship between the United States and Saudi Arabia. Today, the Saudis have special military concessions with America partly for geographic strategical reasons but largely because of the oil supply.

Export Partners Chart

Refineries

Nigeria has 4 refineries; Port Harcourt I and II, Warri, Kaduna with a combined capacity of 500,000bbl/day. Estimated 0-15 percent of the refining capacity was operational in 2009, Nigeria used 280,000bbl/day same year. Importation and subsidies cost the FG $3-4bil/year. Poor maintenance, fire, theft and attack on oil infrastructures are largely responsible.

Privatization of the refineries and phasing out subsidies is an option to be considered.

Distribution network

Depots. Depots. Depots. Also encourage investments in oil transportation industry by providing incentives such as tax breaks.

To Download policy